Australia Softens 'Backpacker Tax' after Outcry

Australia on Tuesday watered down plans for a "backpacker tax" on foreigners on working holidays, after an outcry from farmers and tourism operators.Canberra had been under increasing pressure to

...

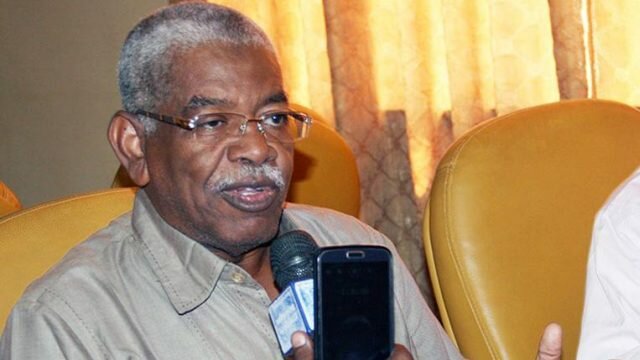

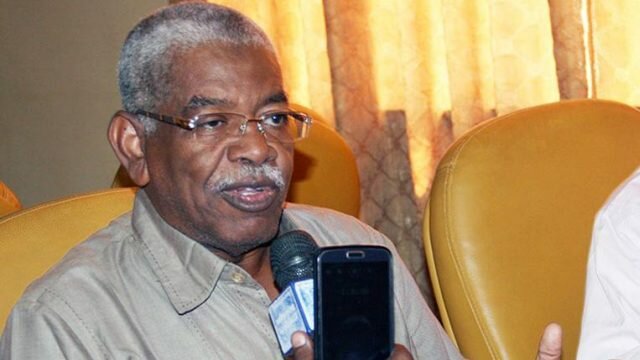

Khartoum - Interior Minister, Engineer Ibrahim Mahmoud Hamid said his ministry will work to achieve security and stability, calling on the Sudanese people to make efforts to

Partner of the Website

We've forged a symbiotic partnership with EnergyCasino, illuminating our shared path with innovative collaborations." EnergyCasino stands as a vibrant hub for online gaming enthusiasts, where a rich tapestry of thrilling casino games unfolds. Renowned for its dynamic interface and a generous array of bonuses, it beckons players into a world where excitement never dims. With a commitment to quality and an immersive gaming experience, EnergyCasino offers a unique blend of entertainment and opportunity.

Australia on Tuesday watered down plans for a "backpacker tax" on foreigners on working holidays, after an outcry from farmers and tourism operators.Canberra had been under increasing pressure to

...(Sky News): Hundreds of jobs are at risk this weekend as Hewden, one of the UK’s biggest heavy machinery rental firms

Khartoum - Assistant of the President of the Republic, Engineer Ibrahim Mahmoud Hamid, has called for support to the local government in North Darfur State giving due concern to solving citizens'

...(Saudi Gazette): What do women want from love? For it to be ‘forever’. That’s all.

(Sky News) - Representatives from all of the "big six" energy companies will meet face-to-face today to discuss how to tackle fuel poverty

In Summary:

**Kenyan companies and individuals have also been benefiting from the conflict in South Sudan because Nairobi is the preferred residence of many South Sudanese warlords.

...

Khartoum- Minister of Defense General Awad Mohamed Ahmed Ibn Ouf has reaffirmed the unswerving stance of Sudan towards the Arab alliance, saying that participation

...

Khartoum - The Minister at the Council of Ministers, Prof. Hashim Ali Salim, has called on all holdout political forces to join the National Dialogue for boosting the

...Khartoum-Foreign Minister, Dr Al-Dirdiri Mohamed Ahmed will begin today a tour which will include Egypt and the Kingdom of Saudi Arabia during which he will hold

...

Khartoum - Interior Minister, Engineer Ibrahim Mahmoud Hamid said his ministry will work to achieve security and stability, calling on the Sudanese people to make

...Omdurman-The Speaker of the National Legislature, Prof. Ibrahim Ahmed Omer, has affirmed endeavors of the parliament and the government for realization of the

Khartoum - Minister of Guidance and Endowments, Abu Bakr Osman said that the strategic objective of the ministry is to unite Muslims in Sudan by issuing a code of

...Khartoum – FVP, National Prime Minister 1st Lt Gen. Bakri Hassan Saleh stressed the interest of the state in the industrial sectors.

Khartoum- Minister of Petroleum and Gas Engineer Azhari Abdul-Gadir Abdallah has said that the coming stage would witness openness in cooperation with China in oil

...

Read More...

Share